carried interest tax reform

The alternative minimum tax AMT would be repealed for all taxpayers. Ad TaxInterest is the standard that helps you calculate the correct amounts.

Carried Interest Tax Break Unites Pe Firms As Congress Takes Aim Bloomberg

Federal income tax rate only if the underlying asset was held for more than three years at the time of sale.

. July 29 2022 Advisories. Thats made the so-called carried interest loophole a favorite target of politicians who call it part of a system rigged to benefit the rich while exacerbating income inequality. The Bill would consolidate the tax brackets for all individual taxpayers and reduce the maximum corporate tax rate to 20.

The Inflation Reduction Act of 2022. Tax Rate and Business Tax Reform. 1 The bill includes changes to Section 1061 of the Code which.

Director Tax Product Development. Japans Financial Services Agency on 22 April 2021 released information in English regarding the tax treatment of carried interest. US Senate Democrats are preparing legislation that they promise will close the carried interest loophole.

On January 7 2021 the Department of the Treasury and the IRS issued final regulations under Section 1061 of the Internal Revenue Code regarding the taxation of carried interests. Closing corporate tax breaks and loopholes including the carried interest loophole individual private equity firms and the major trade group representing their industry the American Investment Council are investing in top tier lobbying talent to save their preferential tax treatment. The grant of a carried interest without liquidation value would continue to be tax-free but holders would need to take into account a three-year holding period to obtain the preferential tax rate.

Thats tax jargon for the share of investors profits that goes to the managers of private. WASHINGTON Fierce lobbying by the private equity industry is the reason the carried interest tax rate is not included in President Joe Bidens planned tax hikes top White House economist. Earlier drafts of President Bidens Build Back Better legislation had language that would require private equity managers to hold assets for at least five years before they could qualify for a break on their carried interest taxes.

Carried interest also referred to as the carry which might entail 20 of the funds profits over a set period typically annual with the exception of private equity funds. Section 1061 was added to the tax code as part of the 2017 tax reform legislation and generally provides that capital gain allocated under certain carried interest arrangements is eligible for the favorable 20 US. Senate Majority Leader Chuck Schumer D-NY and Sen.

Carried interest or carry is a share of any profits that the general partners of private equity and hedge funds receive as compensation regardless of whether or not they contributed any initial. Easily Project and Verify IRS and State Interest Federal Penalty Calculations. 12 The private equity industry has spent over 25 million in lobbying since 2020 according to.

Its only created when the fund generates profits. In January 2021 the US. April 26 2021.

Department of Treasury and the Internal Revenue Service released final regulations the Final Regulations under Section 1061 of the Internal Revenue Code of 1986 as. The carried interest rules would be expanded to include income that is subject to tax at capital gains tax rates eg qualified dividend income as well as applying to a partnership interest that is received in connection with performing substantial services with respect to a section 1061 applicable trade or business ie raising capital. Joe Manchin III D-WVa have reached an agreement on a corporate tax reform proposal that would impose a corporate minimum tax rate of 15 percent narrow the carried interest tax break and boost IRS funding.

The rate reductions would also be available for US. These rules make some notable and mostly taxpayer-friendly changes to regulations proposed in July 2020. The English-language guidance is provided on a webpage and includes an English version of a previously released notice PDF 465 KB addressing the tax treatment of carried interest.

Senators Manchin and Schumer this week announced that the Inflation Reduction Act of 2022 will be added to the FY2022 Budget Reconciliation bill. The Proposal would repeal Section 1061 1 the three-year carry rule that was enacted as part of the 2017 tax reform legislation and instead subject the holder of a carried interest to current inclusions of compensation income taxable at ordinary income rates in amounts that purport to approximate the value of a deemed interest-free. 2 days agoThe Inflation Reduction Act of 2022 bill includes changes to Section 1061 of the Codechanges for real estate operators and investors is the Section 1231 gains will now be subject to a three-year.

The loophole is called carried interest. 2 days agoThe carried interest loophole is a stain on the tax code. If passed the measure would have.

The industry strongly opposed extending the holding period to three years as part of tax reform legislation enacted in 2017 but notes that final regulations released in January 2021 exclude Section 1231. New Bill Will Tax Real Estate Promote as Carried Interest Subject to Three-Year Holding Period. Carried interest isnt guaranteed.

NMHCNAA believe that carried interest should be treated as a long-term capital gain if the underlying asset is held for at least one year. Its usually tied to a specified rate of return known as profits over. Tax-exempt investors subject to tax under the UBTI rules.

It does not help small businesses pension funds other investors in hedge funds or private equity and everyone in the industry knows it.

How To Tax Capital Without Hurting Investment The Economist

I Robot U Tax Considering The Tax Policy Implications Of Automation Mcgill Law Journal

What Are The Consequences Of The New Us International Tax System Tax Policy Center

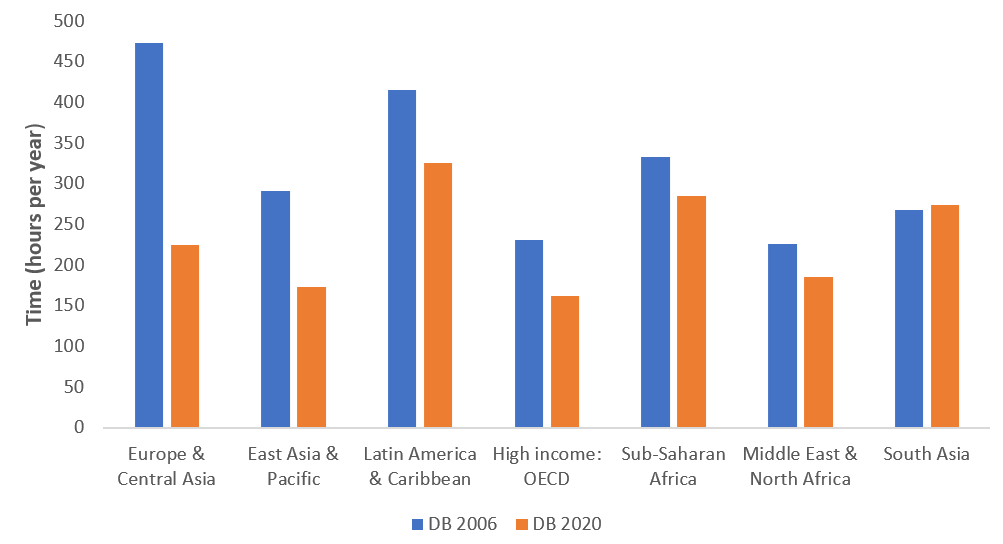

Paying Taxes Reforms Doing Business World Bank Group

What Are The Consequences Of The New Us International Tax System Tax Policy Center

Carried Interest Tax Break Unites Pe Firms As Congress Takes Aim Bloomberg

The Impacts Of Us Tax Reform On Canada S Economy Business Council Of Canada

The Impacts Of Us Tax Reform On Canada S Economy Business Council Of Canada

How Do Taxes Affect Income Inequality Tax Policy Center

The Impacts Of Us Tax Reform On Canada S Economy Business Council Of Canada

How Do Taxes Affect Income Inequality Tax Policy Center

Tax Reform Is Affecting M A And Private Equity Jones Day

The Impacts Of Us Tax Reform On Canada S Economy Business Council Of Canada

How Do Taxes Affect Income Inequality Tax Policy Center

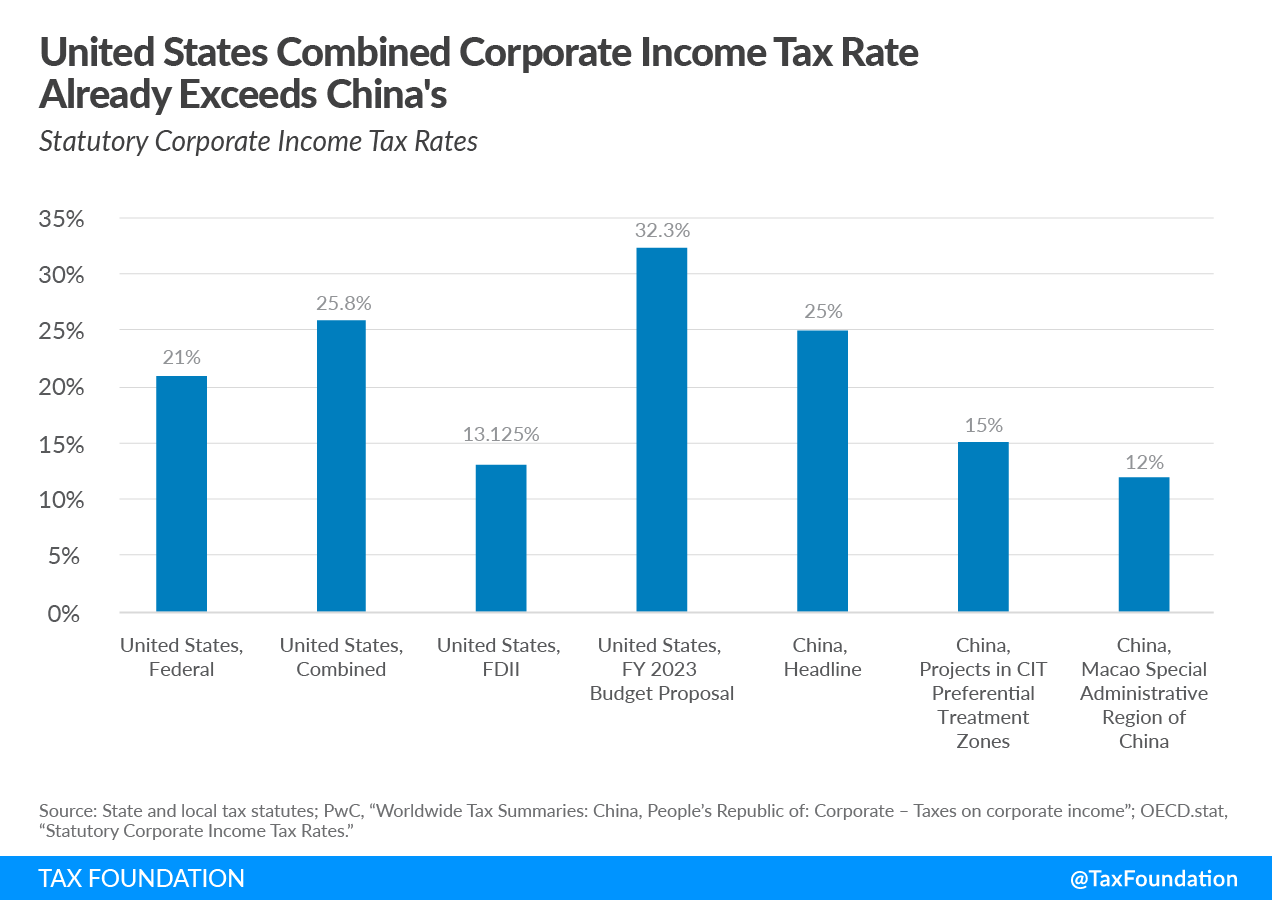

Us China Competition Usica Competes Act Corporate Tax Comparison

The Relationship Between Taxation And U S Economic Growth Equitable Growth

:strip_icc()/trump-s-tax-plan-how-it-affects-you-4113968-6d78115126514c15a71278d826a751ed.gif)